Help with NJ SAIP Policy

Only a Medicaid eligible person may obtain a NJSAIP or Dollar-A-Day Auto Policy.

NJSAIP Program Description

The Special Automobile Insurance Policy (SAIP) is an initiative to help make limited auto insurance coverage available to drivers who are eligible for Federal Medicaid with hospitalization. Such drivers can obtain a medical coverage-only policy at a cost of $365 a year.

To get help obtaining a policy call (856) 352-2454 or use the quick contact form for a callback.

The SAIP policy covers emergency treatment immediately following an accident and all treatment of serious brain and spinal cord injuries up to $250,000. The SAIP policy also provides a $10,000 death benefit.

A NJSAIP policy DOES NOT COVER damage you may cause to other persons or property (liability coverage), or damages to your own car (collision and comprehensive coverage’s). The SAIP policy also does not cover outpatient treatment (non emergency doctor visits, physical therapy, etc.).

Fees

None to apply. The insurance policy, if obtained, costs $365 per year.

Eligibility

General Requirements:

Applicant must be currently uninsured.

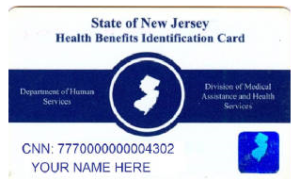

Applicant must be enrolled in a Medicaid program that provides hospitalization. Not all Medicaid enrollees are eligible. To determine if you are eligible, bring your Medicaid ID card to an insurance producer. Insurance producers can determine eligibility by contacting Medicaid.

Special Automobile Insurance Policy(SAIP) provides emergency room care and catastrophic care to certain Medicaid recipients who receive hospitalization benefits. It is available for $360 a year, or $365 if paid in two six-month installments. SAIP works in tandem with Medicaid to ensure that the low-income driver covers all his or her costs to the hospital system in the event of an accident

What does it cover?

Emergency treatment immediately following an accident and treatment of serious brain and spinal cord injuries up to $250,000. It also provides a $10,000 death benefit.

Will my policy be cancelled if my Medicaid benefits are discontinued? The applicant must demonstrate enrollment in Medicaid when the policy is first written and at each renewal. If the insured is no longer enrolled in Medicaid during the policy term the policy will not cancel, but the insured will receive only the limited benefits of the policy.

This SPECIAL type of car insurance is not dependent upon any certain age so senior citizens as well as younger drivers may be eligible. This type of car insurance policy makes you legal to drive but does not provide any protection (Liability coverage’s).

What does it not cover?

Outpatient treatments such as doctors’ visits covered by Medicaid, damage you may cause to other persons or property (liability coverage), or damages to your own car (collision and comprehensive coverage’s).

1. LIABILITY-BODILY INJURY and PROPERTY DAMAGE LIABILTY

Not available

2. PERSONAL INJURY PROTECTION (PIP) MEDICAL EXPENSE LIMIT

Emergency services, plus $250,000 for catastrophic injuries only

3. PERSONAL INJURY PROTECTION MEDICAL DEDUCTIBLE

Not available

4. HEALTH INSURER FOR PIP OPTIONS

Not available

5. EXTRA PIP PACKAGE COVERAGE – Non Medical Benefits

Not available

6. UNINSURED/UNDERINSURED MOTORIST COVERAGE

Not available

7. COLLISION COVERAGE

Not available

8. COMPREHENSIVE COVERAGE

Not available

9. LAWSUIT OPTION

Limitation on Lawsuit Option